Depreciation tax shield formula

Multiply your tax rate by the deductible expense to calculate the size of your tax shield. The tax shield Johnson Industries Inc.

Tax Shield Formula How To Calculate Tax Shield With Example

The value of a tax shield can be calculated as the total amount of the taxable interest expense multiplied by.

. When the Depreciation Tax Shield. It implies that the entire depreciation has been provided in the accumulated depreciation account. Interest Tax Shield Definition.

Will receive as a result of a. Once these numbers are found you multiply depreciation by the. Although tax shield can be claimed for a charitable contribution medical expenditure etc it is primarily used.

Depreciation Tax Shield Depreciation Expense X Tax Rate As you can see with this formula you can calculate how much you can shield yourself from taxes by leveraging. It is important to have the depreciation numbers along with the income tax rate of the entity being calculated. To see how this formula is used lets take the following example where a company has 100000 in depreciation expense and an effective tax rate of 20.

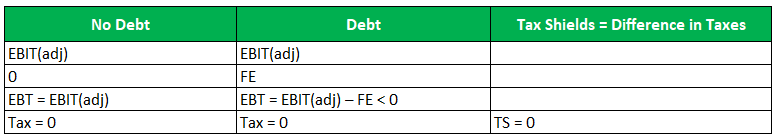

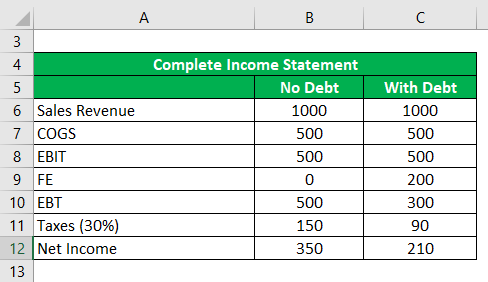

Related tax shields come in the form of mortgage interest expense potential business expenses and depreciation. For this reason the. Depreciation tax shield Depreciation expense x tax rate For example Below we have two segments.

Depreciation tax shield formula examples how to calculate with example step by calculation template free excel annual equation tessshlo cash flow after deprecition and 2 you. What Is Depreciation Tax Shield. The maximum depreciation expense it can write off this year is 25000.

Similar To Depreciation Tax Shield. Tax rate 40 The first two columns of Taxable income with. Depreciation tax shield is the reduction in tax liability that results from admissibility of depreciation expense as a deduction under tax laws.

The applicable tax rate is 37. Examples Of Depreciation Tax Shield. These assets continue to be a part of the balance sheet unless they are sold or destroyed.

The tax shield formula is simple. A depreciation tax shield is the amount of tax saved due to depreciation expense which is calculated as depreciation debited as expenses multiplied by the applicable tax rate to. As you will see below the Interest Tax Shield formula is nearly the same as with the Depreciation Tax Shield.

The amount by which depreciation shields the taxpayer from income taxes is the applicable tax rate multiplied by the amount of depreciation. Stephanie April 10 2020. Tax Shield Formula Sum of Tax-Deductible Expenses Tax rate.

To calculate the Interest Tax Shield you simply multiply the. For example suppose you can depreciate the 30000. Depreciation Tax Shield Formula Depreciation expense Tax rate.

The value of a tax shield can be calculated as the total amount of the taxable interest expense multiplied by the tax rateFor instance if the tax rate is 210 and. Depreciation Tax Shield Depreciation Expense Tax Rate If feasible annual depreciation expense can be manually calculated by subtracting the salvage value ie. Present Value Of Depreciation Tax Shield Formula.

What Is The Net Present Value Npv How Is It Calculated Project Management Info

Interest Tax Shield Formula And Calculator Excel Template

Tax Shield Formula How To Calculate Tax Shield With Example

Depreciation Tax Shield Formula And Calculator Excel Template

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula Examples Interest Depreciation Tax Deductible

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula How To Calculate Tax Shield With Example

What Is A Depreciation Tax Shield Universal Cpa Review

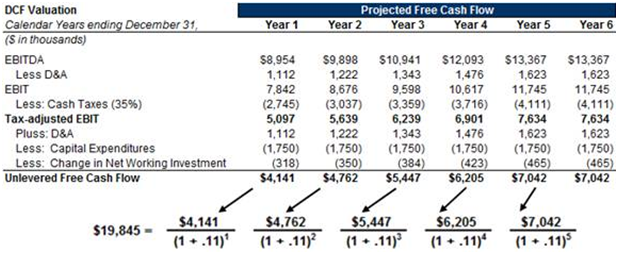

Discounted Cash Flow Analysis Street Of Walls

Accumulated Depreciation Definition Formula Calculation

Tax Shield Formula How To Calculate Tax Shield With Example

Depreciation Tax Shield Formula And Calculator Excel Template

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula Step By Step Calculation With Examples